XRP News Today: XRP Rally Stalls as SEC Motion Denied and Network Growth Falters

Ripple’s XRP finds itself at a critical juncture, caught between bullish technical signals and mounting on-chain concerns.

The cryptocurrency, which has surged in recent weeks on growing legal clarity and wider market momentum, is now facing turbulence as a court ruling stalls its legal resolution with the U.S. Securities and Exchange Commission (SEC), while underlying network activity weakens.

XRP Lawsuit Hits Procedural Roadblock

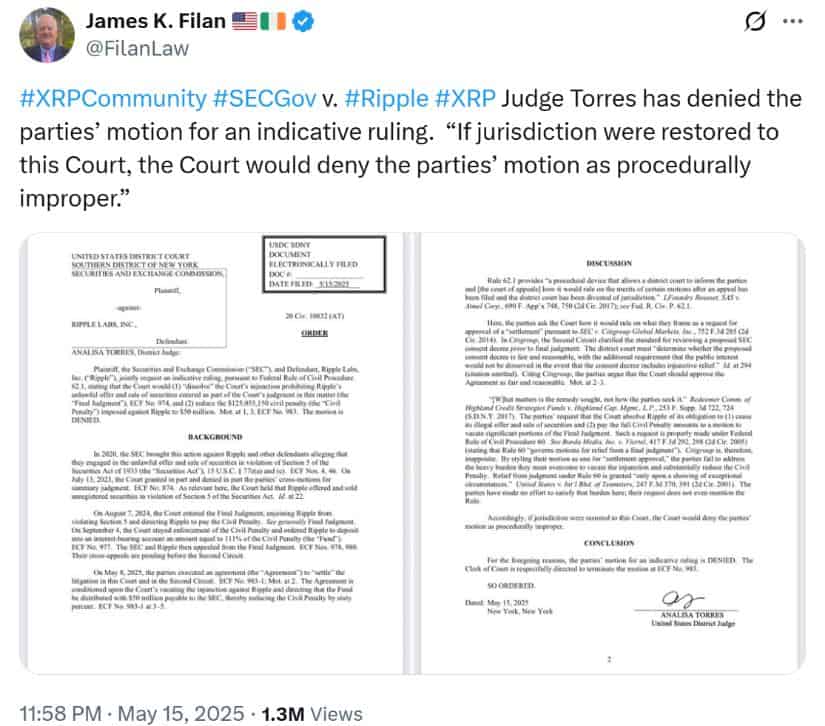

In a pivotal development for the long-standing XRP lawsuit, U.S. District Judge Analisa Torres denied a joint motion by Ripple Labs and the SEC to reduce a $125 million penalty. The request, which proposed slashing the fine to $50 million pending the withdrawal of a previous court injunction, was dismissed due to procedural constraints.

Judge Torres has denied the SEC and Ripple’s motion for an indicative ruling, citing procedural impropriety if jurisdiction were restored. James K. Filan via X

Judge Torres emphasized the court’s obligation to ensure any agreement is “fair and reasonable” and not contrary to public interest. She refrained from providing an indicative ruling, signaling that the proposed settlement requires further judicial scrutiny.

“The District Court must determine whether the proposed consent decree is fair and reasonable,” the judge stated in her ruling, highlighting that years of litigation and judicial resources must not be disregarded.

Despite the setback, Ripple’s Chief Legal Officer Stuart Alderoty assured that the company will continue to work with the SEC to move the case forward. He noted that the rejection does not affect previous victories, reaffirming that XRP itself is not considered a security—a crucial distinction in the broader regulatory landscape for Ripple crypto assets.

XRP Price Holds Ground Above Key Support

Following the court’s decision, the XRP price showed resilience, trading slightly higher around $2.41 after a brief pullback from the weekly high of $2.65. This steadiness comes amid an overall bullish trend that has persisted for several weeks.

XRP has rebounded from the 0.618 Fibonacci level with RSI above 50, indicating bullish momentum. Source: Contradnging on TradingView

Technical indicators reflect continued strength in Ripple XRP news. The Moving Average Convergence Divergence (MACD) remains in bullish territory, and XRP continues to trade above the 50-day, 100-day, and 200-day Exponential Moving Averages—supporting a positive XRP price prediction with a short-term target of $3.00.

However, traders are keeping a close watch on immediate support at $2.40 and resistance near the recent peak. A decisive move above $2.65 could reignite momentum, while a failure to hold support may expose the token to a retest of the $2.00 level.

XRP Network Activity Flags Caution

Despite positive price signals, fundamental on-chain metrics are showing signs of stress. XRP Ledger network growth has plummeted strongly, which points to weakening demand. Data from Santiment shows new addresses dropped from nearly 16,000 in January to over 3,400 in mid-May—a steep 78% drop.

This contraction in network usage is a concern for ongoing bullish momentum. According to analysts, waning usage could strip the overall rally of some steam, especially if it indicates declining investor interest or decelerating usage of the Ripple ledger for real-world applications.

At the same time, the market for XRP derivatives is slowing down. In the last 24 hours, $10.14 million of XRP positions were liquidated, and the majority of the positions were long, CoinGlass data shows. The drop in trading volume—from $19.5 million on Monday to $8.69 million on Thursday—once again illustrates waning speculative demand.

The slight 1% decline in open interest to $5.41 billion points to a mild unwinding of leveraged positions, potentially due to profit-taking after XRP’s recent upswing.

Legal Uncertainty Meets Market Hesitation

While Ripple continues to battle legal uncertainty in the XRP SEC cases, the recent dismissal of the joint motion has cast temporary shadows on the bull run. However, Ripple CEO Brad Garlinghouse and the legal team are confident in the long-term status of the firm.

Today’s order leaves Ripple’s wins intact and focuses solely on procedural issues, which both parties plan to revisit together. Source: Stuart Alderoty via X

Interestingly, the rejected motion does not reverse the 2023 ruling that XRP’s secondary market sales are not securities. This distinction has assured a broad legal win for Ripple in its years-long dispute with the SEC, upholding investor confidence in XRP value and offering a potential precedent for other digital assets.

Outlook: Will XRP Reclaim Momentum?

Looking ahead, XRP’s path to $3.00 hinges on both technical confirmation and renewed network growth. Traders may watch for support levels near $2.25 to $2.00, particularly if the RSI, which is approximately 56—drops below the 50 level and shows diminishing momentum.

If Ripple is able to obtain a positive legal outcome and revive user activity on the Ripple ledger, XRP can still recover its bull run. Additionally, partnerships such as Ripple’s established one with Bank of America would make it easier to resume institutional demand and facilitate Ripple currency price in the medium term.

In the short term, XRP is in a consolidation period, balancing between solid technical support and general fundamental headwinds. While optimism persists among long-term holders, the market waits for clearer signals—both in courtrooms and on-chain.