Whales Are Buying: 3 Altcoins Exploding with Massive Whale Activity in Early May 2025

Jakarta, Pintu News – Bitcoin’s decisive break through the psychological barrier of $95,000 has reignited bullish momentum in the crypto market. Along with the growing positive sentiment among investors, crypto “whales” started buying a number of different altcoins this week.

Some of their top picks include Avalanche (AVAX), Ethereum (ETH), and Pepe meme coin (PEPE), all of which recorded large inflows from whales during the week.

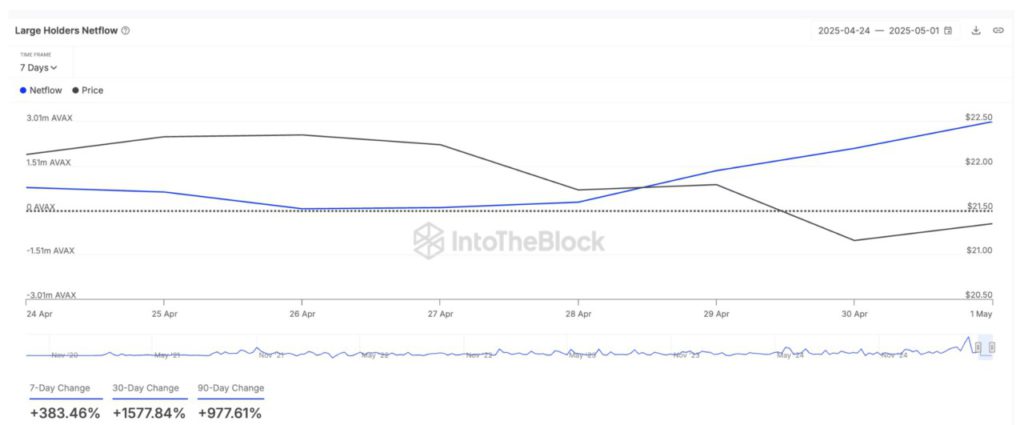

Avalanche (AVAX)

Layer-1 (L1) coin AVAX caught the attention of crypto whales this week, as seen by the sharp spike in the netflow of large holders. According to data from IntoTheBlock, this netflow jumped by more than 380% in the last seven days.

Read also: Crypto Shake-Up Coming? These 3 Altcoins Are Releasing Massive Token Unlocks This Week!

Large holders are wallet addresses that own more than 0.1% of the total circulating coin supply. The large holder netflow tracks the buy and sell activity of these large investors.

When net flows increase, it means that whales are buying more tokens. This bullish signal often encourages retail investors to add to their holdings.

If this accumulation trend of AVAX continues, the price of the coin has the potential to break the resistance level at $24.28 and continue the rally towards $30.23.

Conversely, if demand weakens, the price of AVAX could drop to as low as $14.66.

Ethereum (ETH)

Amid the recent broader crypto market rally, ETH recorded a relatively modest price increase of 3% in the past seven days, driven by steady accumulation from whales.

According to data from Santiment, in that period, whale addresses holding between 10,000 and 100,000 ETH have accumulated a total of 280,000 ETH, worth more than $510 million based on current market prices.

As of now, the ETH whale group controls 25.24 million ETH-their highest amount in the past month. If this accumulation trend continues, ETH prices could potentially break the psychological barrier of $2,000.

However, if the selling pressure from the bearish side strengthens again, the ETH price could be pushed down to the $1,733 level.

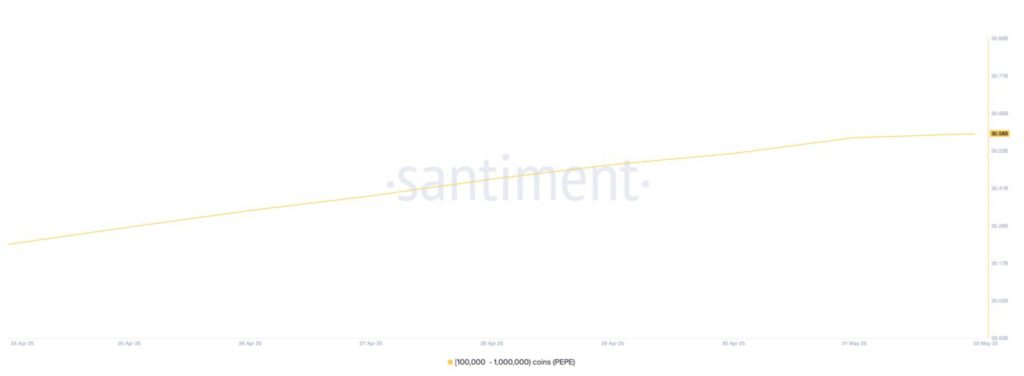

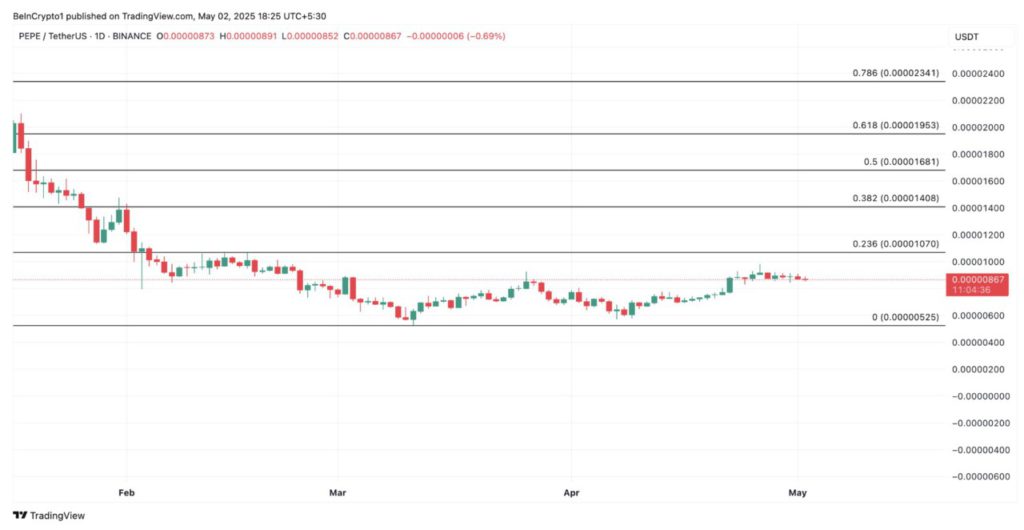

Pepe (PEPE)

The popular meme coin PEPE was another asset that saw a surge in accumulation from crypto whales this week.

Read also: Whales Are Loading Up on These 4 Cryptos — Should You Follow?

According to data from Santiment, wallet addresses holding between 100,000 to 1 million tokens have purchased as much as 350 million PEPE in the last seven days.

As of May 2, PEPE was trading at $0.0000086. If the accumulation trend by whales continues, PEPE has the potential to reverse the current downward trend and break the resistance level at $0.000010.

Conversely, if the selloff continues, the token’s price could drop to as low as $0.0000052.

That’s the latest information about crypto. Follow us on Google News to stay up-to-date on the world of crypto and blockchain technology.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Get a web trading experience with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference: