Is Bitcoin (BTC) Heading Toward $110,000? Here’s the Latest Analysis After the US Inflation Data!

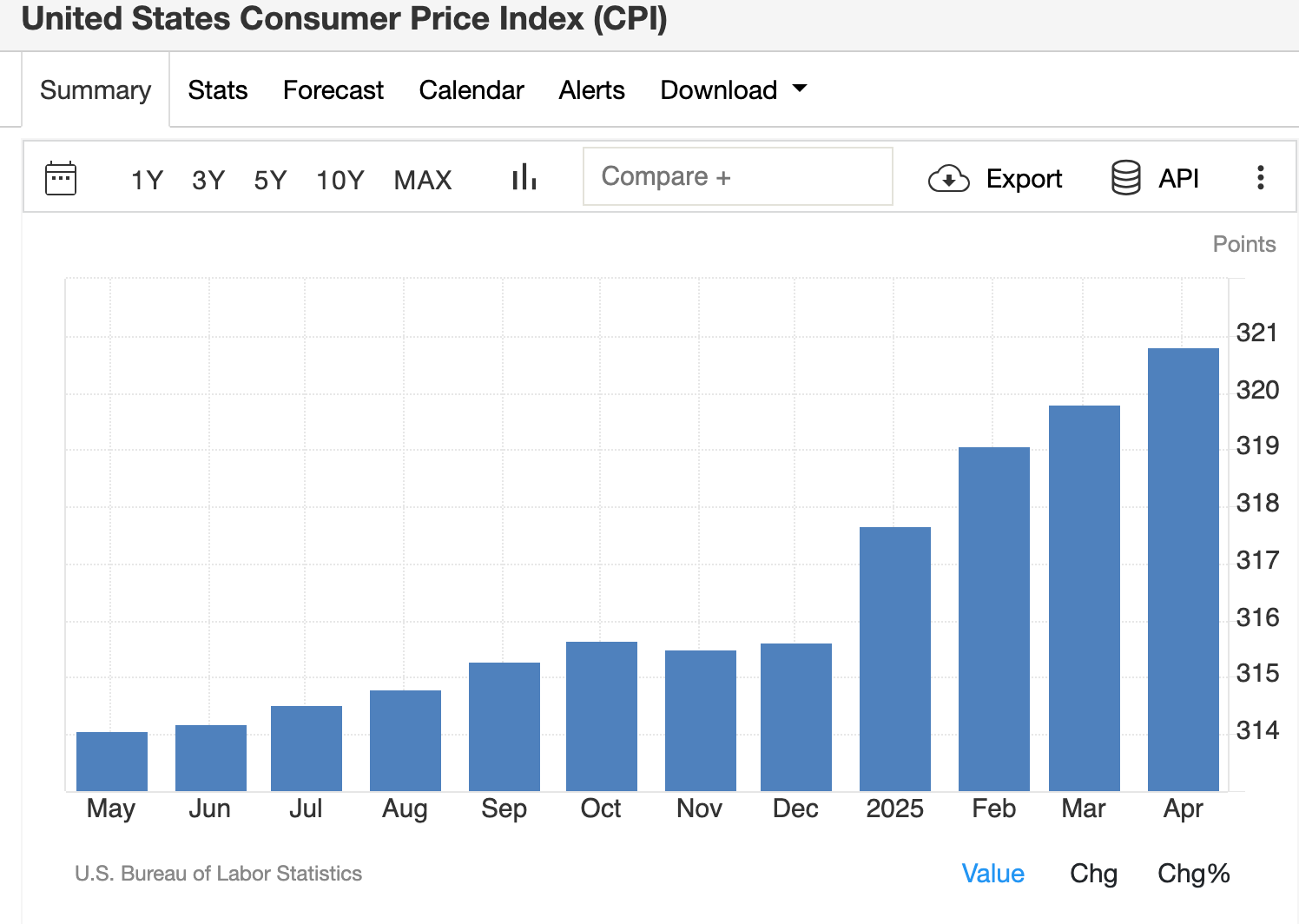

Jakarta, Pintu News – On Monday, Bitcoin experienced a sharp rise following the latest announcement regarding the United States Consumer Price Index (CPI) for April. The data showing a decline in inflation has sparked optimism in the cryptocurrency market, with Bitcoin (BTC) now eyeing a price target of $110,000.

Check out the full analysis below!

Market Reaction to Inflation Data

After the release of the United States CPI data for April which showed an increase of only 0.3% from the previous month, global financial markets showed a positive response. The S&P 500 index rose 1.1% to reach 5,300 points, while Bitcoin (BTC) trading volume on Binance increased by 35%.

This rise signaled increased investor confidence in riskier assets, including stocks and cryptocurrencies. The lower-than-expected CPI data also affected market expectations for the Federal Reserve’s interest rate policy.

With inflation seemingly under control, many market participants are now expecting an interest rate cut in the near future, which could further boost the appeal of Bitcoin (BTC) as an investment asset.

Read also: SEC Delays Solana and Litecoin ETFs, What’s the Impact?

Technical Analysis and Market Sentiment

From a technical perspective, Bitcoin (BTC) is showing strong bullish signals. Based on data from TradingView, Bitcoin (BTC) managed to break the upper limit of the Bollinger Band indicating further upside potential.

The RSI (Relative Strength Index) is above 70 signaling overbought conditions, but there are no signs of significant weakening of momentum. In addition, high trading volume and buyer dominance as seen from the surge in Delta Volume are other indicators supporting the bullish outlook.

As long as Bitcoin (BTC) holds above the psychological support of $100,000, the chances of reaching $110,000 remain wide open.

Also read: Donald Trump’s Exclusive Dinner with Meme Coin Holders: Who Attended?

Upcoming Market Predictions and Expectations

With favorable inflation data, as well as positive technical conditions and market sentiment, Bitcoin (BTC) has great potential to reach a new record price above $110,000. Investors and traders will continue to monitor upcoming statements from Federal Reserve Chairman Jerome Powell as well as the release of the FOMC minutes for further clues regarding the direction of US monetary policy.

This rise in Bitcoin (BTC) price has also been followed by increased interest in other cryptocurrency assets, which could trigger a bullish wave across the market. However, it is important to stay alert to geopolitical risks and sudden changes in economic policies that could affect market sentiment.

Conclusion

With various supporting factors, both from economic data and technical analysis, the current outlook for Bitcoin (BTC) is very positive. While there are some risks to be aware of, the current trend suggests that Bitcoin (BTC) is on track to reach and possibly even surpass its $110,000 price target in the near future.

That’s the latest information about crypto. Follow us on Google News to stay up-to-date on the world of crypto and blockchain technology.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference