Ethereum Stalls at $2,400 as Whale Numbers Plunge — Is a Big Move Coming?

Jakarta, Pintu News – Ethereum has gained more than 58% in the last 30 days, with nearly 40% of that gain occurring in just the last 10 days. Despite the sharp surge, some important indicators are starting to show warning signals.

The BBTrend indicator has turned negative, accumulation by whales has started to decline, and the momentum of the short-term EMA appears to be weakening. These signals suggest that Ethereum may be approaching a crucial point, where it needs renewed buying pressure to sustain its uptrend-or risk a reversal.

Then, how will Ethereum price move today?

Ethereum Price Drops 2.25% in 24 Hours

As of May 19, 2025, Ethereum (ETH) was trading at approximately $2,424, or around IDR 40,161,362, after slipping 2.25% over the past 24 hours. During this time, ETH reached a high of IDR 42,631,403 and a low of IDR 39,069,369, reflecting a day of notable volatility in the market.

At the time of writing, data from CoinMarketCap shows that Ethereum’s market capitalization stands at around $292.18 billion, with daily trading volume rising 60% to $26.8 billion within the last 24 hours.

Read also: Dogecoin Soars 8% as Whale Unleashes 170 Million DOGE—Market on Edge

BBTrend of Ethereum Turns Negative After Month-long Spike

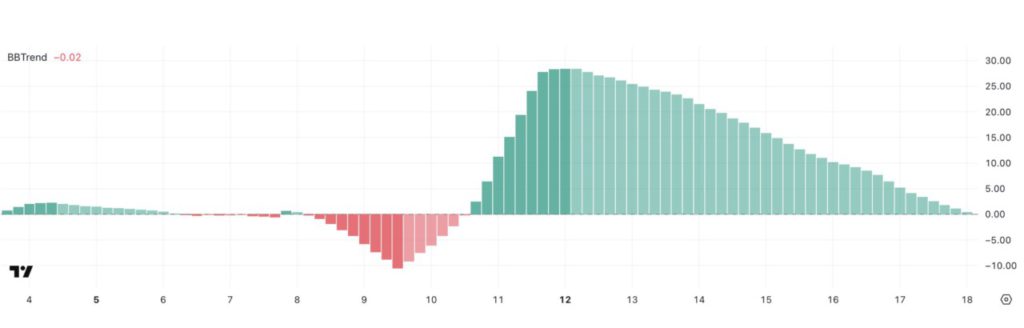

The BBTrend indicator for Ethereum has just entered negative territory, now standing at -0.02 after maintaining a positive trend for about seven consecutive days.

This change comes after reaching a strong peak of 28.39 on May 12, which signaled the end of the bullish phase.

This move below zero comes after Ethereum surged 58.5% in the past month, raising the question of whether the asset is entering a consolidation phase or starting to show signs of an early correction.

BBTrend, or Bollinger Band Trend, measures price momentum relative to volatility by assessing how far the price movement deviates from its average within the Bollinger Bands.

When the BBTrend value is positive, it generally indicates bullish momentum, while negative values indicate the market may be losing strength or entering a bearish phase.

With ETH’s BBTrend now slightly below zero, this could be a signal that buying pressure is starting to weaken after the recent rally. If this trend continues to decline, the price of Ethereum could potentially be held back or experience a correction as traders start to become more cautious.

Ethereum Whale Count Drops Below Key Levels

Ethereum whale activity is showing signs of decline after a steady period over the past few weeks.

Wallet addresses holding between 1,000 and 10,000 ETH – categorized as Ethereum whales – have been holding above the 5,440 mark since mid-April, even reaching 5,463 on May 8.

However, in the past 10 days, this number has slowly decreased despite minor fluctuations.

Read also: Space Meets Blockchain: Filecoin and Lockheed Martin Redefine Data Transmission

Currently, the number stands at 5,393, marking the first time it has fallen below 5,400 since April 9-a psychologically and historically important level for large holders.

Monitoring the movements of Ethereum whales is important because these wallets often act as market movers due to the sheer volume they hold. When the number of whales increases, it usually signals accumulation, reflecting confidence and long-term positions.

Conversely, a decrease in the number of whales could indicate distribution, profit-taking, or caution from big players.

This latest drop could be interpreted as a weakening of confidence from large investors after ETH’s recent strong rally, potentially leading to increased volatility or a lull period in price momentum.

This drop also comes at a time when analysts are starting to speculate whether ETH could surpass BTC, while others are questioning whether ETH is still a viable investment in 2025.

ETH Struggles Around $2,700-Can Bulls Reclaim $3,000 Level?

Ethereum’s EMA (Exponential Moving Average) line is still showing bullish signals, with the short-term EMA being above the long-term EMA.

However, the momentum is starting to weaken, as evidenced by the short-term EMA lines starting to flatten and the gap between the lines narrowing. Patterns like this often signal a possible change in trend direction, especially if buyers fail to take back control.

Although the overall structure is still positive, losing upward momentum creates uncertainty in the short term.

ETH price has been struggling to break through key resistance levels at $2,741 and $2,646 in recent days.

Without a fresh buying push, the asset could fail to reclaim the $3,000 psychological level-which it hasn’t touched since February 1.

If selling pressure increases, Ethereum could potentially fall back to the support area at $2,408. If this level is broken, further declines could occur, with the next significant support zones being at $2,272 and $2,112.

That’s the latest information about crypto. Follow us on Google News to stay up-to-date on the world of crypto and blockchain technology.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference: