Ethereum Price Rockets to $2,700 Today — ETH Longs Smash Shorts for the First Time This Week!

Jakarta, Pintu News – Bitcoin’s rise to a new record high (All-Time High) of $111,888 on May 22, 2025 had a positive impact on the crypto market at large, giving many altcoins a boost.

One of the biggest beneficiaries was Ethereum , which also briefly rose up to 3%, fueled by renewed bullish sentiment and a surge in activity in the futures market.

Then, how is Ethereum’s current price movement?

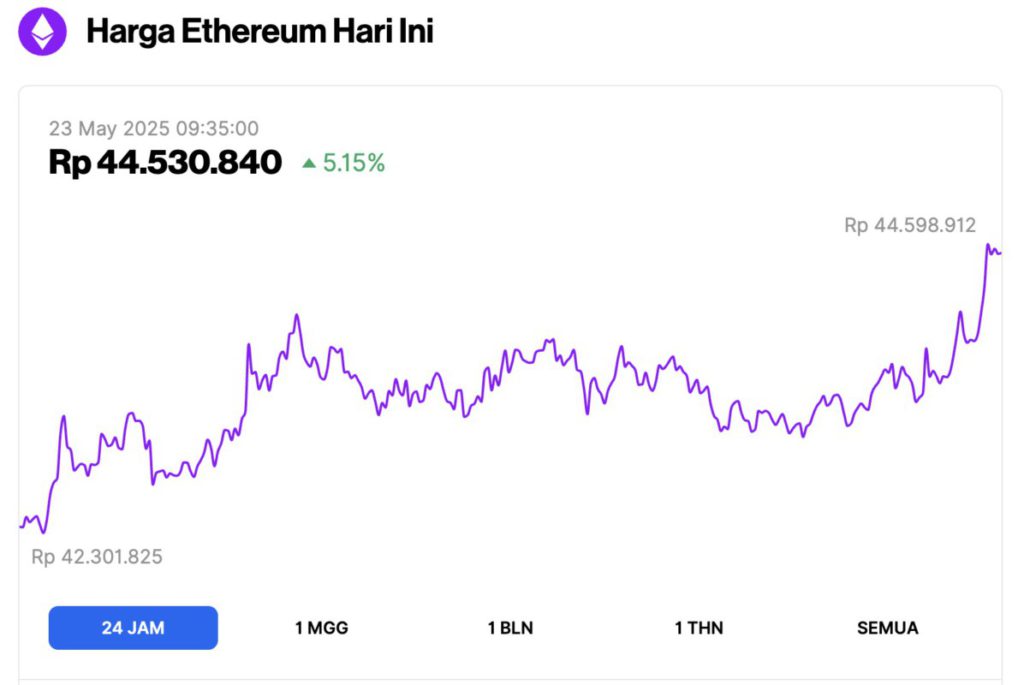

Ethereum Price Up 5.15% in 24 Hours

As of May 23, 2025, Ethereum (ETH) surged to around $2,721 (IDR 44,530,840), marking a sharp 5.15% jump in just 24 hours! Within this whirlwind day, ETH dipped as low as IDR 42,301,825 before skyrocketing to a high of IDR 44,598,912 — showing signs of serious bullish momentum.

At the time of writing, data from CoinMarketCap shows that Ethereum’s market capitalization stands at around $328.28 billion, with daily trading volume falling 13% to $29.11 billion within the last 24 hours.

Read also: Ethereum Founder Jeffrey Wilcke Moves $262 Million Worth of ETH, What’s Up?

Ethereum Futures Market Shows Signs of Recovery

Demand for long ETH positions has outpaced short positions for the first time in 11 days, signaling a significant shift in trader positioning.

According to Coinglass, ETH’s long/short ratio has risen above 1, meaning that more traders are now placing bets on price increases. Currently, the ratio stands at 1.0048.

The long/short ratio measures the ratio between bullish (long) and bearish (short) positions in the market. When this ratio is below one, it means that more traders expect prices to fall than expect them to rise.

Conversely, as is the case with ETH, when the ratio is above one, there are more long positions than shorts. This indicates a bullish sentiment, with the majority of traders expecting the value of the altcoin to increase in the near future.

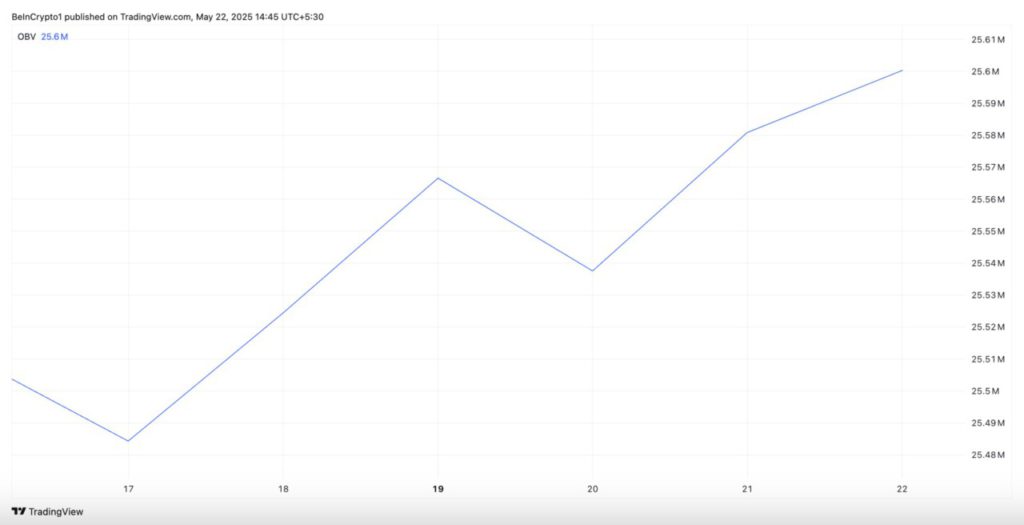

Moreover, on the daily chart, the rise in ETH’s on-balance volume (OBV) also confirms the increased demand for this altcoin. At the time of writing, this important momentum indicator stands at 25.60 million.

On-Balance Volume (OBV) is a technical indicator that measures cumulative buying and selling pressure by adding the volume on days the price goes up and subtracting it on days the price goes down.

As the OBV increases, it signals a surge in trading volume in sync with the price movement, indicating an increasingly strong conviction behind ETH’s forming uptrend.

Strong Sentiment Potentially Drives ETH Price

Furthermore, ETH’s bullish narrative is further strengthened by the growing anticipation associated with the upcoming Ethereum protocol update as well as increasing institutional engagement.

In an interview, Lennix Lai, Global Chief Commercial Officer at OKX, stated that despite a delay from the US SEC in the approval of an Ethereum staking ETF, sentiment towards this major coin remains strong and has the potential to push prices up further.

Read also: Ethereum has the potential to reach the $10,000 level in 2025, says Arthur Hayes!

“Despite the SEC delaying the approval of ETH staking ETFs, the Ethereum narrative is clearly gaining attention, likely driven by anticipation of upcoming updates (e.g. Fusaka) and bullish news from TradFi institutions building Layer 2 Ethereum to tokenize real-world assets (RWAs),” Lai said.

Lai also added on the exchange:

“ETH now accounts for almost 27% of spot volume compared to Bitcoin’s 26.5%, completely reversing the dynamics of April when BTC dominated with 38% while Ethereum was under 20%. This shows a clear rotation as traders shift their positions while Bitcoin consolidates near record highs, despite BTC recently setting a new record at $110,730.”

He described this trend as “quite interesting.”

Ethereum Holds Above 20-Day EMA; Rally Toward $2,745 Seen

As of May 22, ETH is above its 20-day exponential moving average (EMA 20), which reinforces the previous bullish view.

It measures the price of an asset over the last 20 trading days giving more weight to the most recent price.

When the asset price is above the 20-day EMA, it signals short-term bullish momentum and shows that buyers are in control. This confirms the strength of the ETH price increase and provides a dynamic support level at $2,369.

If the rally continues and gets stronger, ETH has the potential to go up to $2,745.

However, if the selling pressure increases again, this bullish outlook will be canceled. In that case, the price of ETH could drop to as low as $2,424.

That’s the latest information about crypto. Follow us on Google News to stay up-to-date on the world of crypto and blockchain technology.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference: