Ethereum (ETH) Price Breaks $2,000 as 50% Spike in Futures Adds Volatility to Crypto Market!

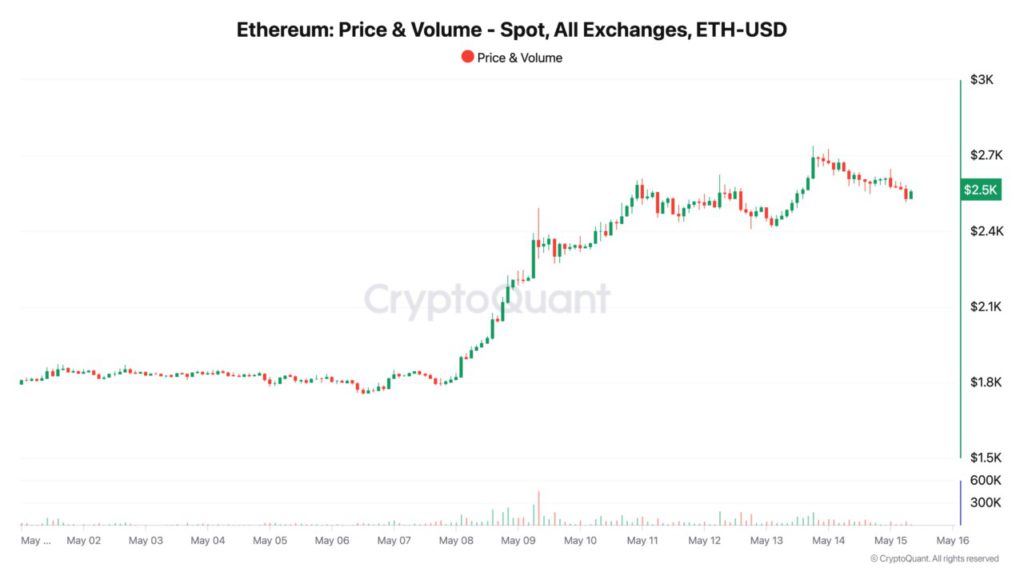

Jakarta, Pintu News – The cryptocurrency market is in turmoil again after Ethereum broke through the psychologically important $2,000 level on May 8, 2025. This price increase triggered a tremendous surge in open interest (OI) for Ethereum futures contracts, which rose by 50% in just two weeks.

From IDR 341.6 trillion ($20.77 billion) on May 1, OI jumped to approximately IDR 511.8 trillion ($31.16 billion) on May 15. This surge marks a significant increase in speculative interest amid bullish momentum in the crypto market.

Check out the full analysis here!

Spike in Open Interest and ETH Breakout Effect

The sharp rise in Ethereum open interest coincided with ETH breaking through the strong resistance level of IDR32 million ($2,000) after being stuck below it for more than two months. The level had been a major roadblock since the overall crypto market correction last March, making market participants hesitant to go deeper.

But once the breakout occurred, traders responded immediately by increasing their exposure to Ethereum futures contracts. This increase in open interest appears to be more reactive than anticipatory, suggesting that market participants only took the plunge after confirmation of price strength.

Also read: Ethereum price rises 7% today (5/20/25), analysts believe ETH can reach $4,000!

Spot vs Futures Market: Emerging Inequalities

Although Ethereum’s spot price also spiked to IDR 44.3 million ($2,700) on May 13, trading volumes on the spot market did not rise as fast as those on futures. This suggests that bullish enthusiasm is being channeled more through derivative instruments rather than direct purchases in the cryptocurrency spot market.

This difference creates potential imbalances in the market, as overexposure in futures without strong support from the spot market could pose a risk of sudden liquidation. When high leverage is not matched by real demand, the market tends to become more fragile and sensitive to short-term price movements.

Read also: US SEC Delays Solana ETF Decision, Will It Finally Be Approved?

Exchange Activity: Retail Vs Institutional

The data shows that the surge in open interest was mainly on exchanges popular with retail traders such as Binance and Bybit. Both platforms recorded strong inflows, indicating that retail speculation played a big role in the recent ETH rally.

In contrast, the Chicago Mercantile Exchange (CME), which is more commonly used by institutional players, has recorded a 5% drop in open interest in the last 24 hours. This suggests that institutions may still be cautious or even taking profit-taking positions amid the rally, a signal that could affect medium-term crypto investor confidence.

That’s the latest information about crypto. Follow us on Google News to stay up-to-date on the world of crypto and blockchain technology.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Get a web trading experience with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference: