DOGE, JASMY, LINK & PI Lead Today’s Rally

As Bitcoin hits new highs, altcoins like Jasmy, Chainlink, Dogecoin, and Pi Network are also soaring. What are the key drivers behind this bullish momentum?

A Strong Comeback Driven by Bitcoin

As the crypto market surpasses the symbolic mark of $3 trillion in market capitalization, investors are witnessing a dramatic surge in several altcoins. Jasmy (JASMY), Chainlink (LINK), Dogecoin (DOGE), and Pi Network (PI) are all delivering notable performances early this month. This trend is driven by the rebound of Bitcoin (BTC), which crossed the psychological threshold of $97,000 for the first time since February. Historically, a bullish BTC momentum acts as a catalyst for all altcoins, a phenomenon widely known as “altseason.”

Analysts are highly optimistic about Bitcoin’s outlook. Ark Invest predicts that the price could reach $2.4 million by 2030. The UK bank Standard Chartered forecasts a BTC price of $120,000 by the end of the year. Joe Burnett, an analyst at Unchained Capital, even considers a push towards $250,000: “If Bitcoin breaks a new all-time high, we could enter an intensified parabolic trend. All signals are green: narratives are aligned, the macro context is favorable.”

Impressive Performances for Altcoins

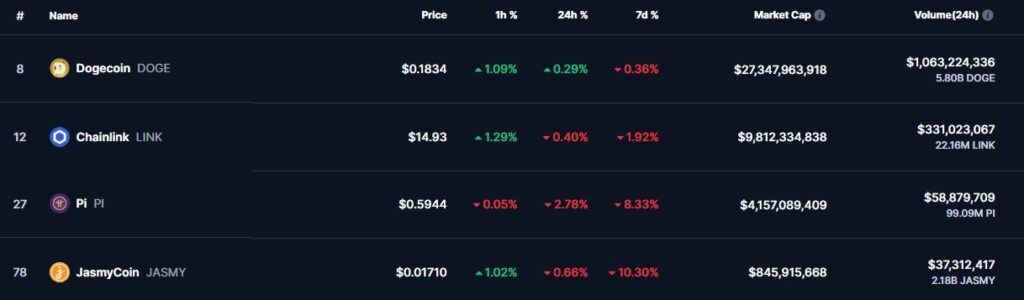

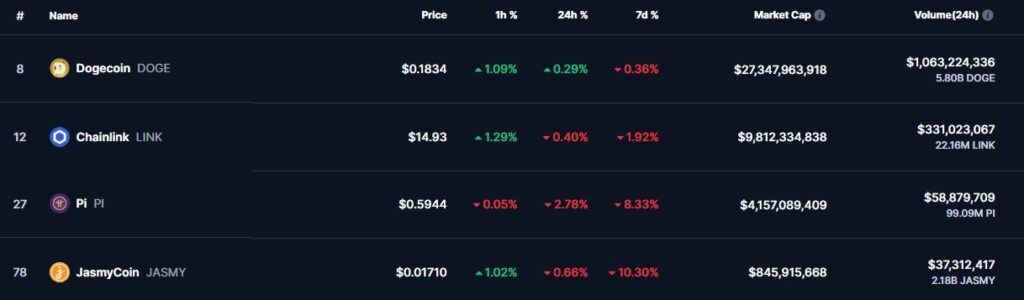

Here are the weekly performances of the mentioned altcoins:

This consistent rise aligns with the overall resurgence of risk appetite in highly volatile and community-driven cryptocurrencies.

The surge in altcoins is also fueled by the rebound in the US stock markets. Dow Jones, S&P 500, Nasdaq 100… all ended the week in the green, with gains exceeding 1%. This uptrend follows Donald Trump’s announcement of tariff reductions as part of his economic stimulus policy.

Furthermore, speculations about an imminent cut in interest rates by the Federal Reserve (Fed) are growing, with the chances of a 25 basis point hike in June now at 47% on the Polymarket platform. Such a move is traditionally seen as positive for risk assets, including most altcoins.

The Key Role of Accommodative Monetary Policy

The link between the accommodative policies of the ECB or the Fed and crypto expansion phases is well established. During the 2021 rally, driven by post-COVID stimulus measures, the crypto market cap exceeded $2.5 trillion. Presently, similar patterns emerge, with massive flows directed towards altcoins.

Notably, tokens with strong community engagement like Dogecoin or Pi Network, or innovative technological offerings like Jasmy in data tokenization, or Chainlink in decentralized oracles, are re-attracting buyers.

While Bitcoin’s dominance remains relatively stable around 52%, signals point to a gradual capital rotation towards altcoins with strong value propositions. This trend could accelerate once Bitcoin reaches new all-time highs, triggering a phase of widespread euphoria in the crypto markets.

DISCLAIMER

This article is for informational purposes only and should not be considered as investment advice. Some of the partners featured on this site may not be regulated in your country. It is your responsibility to verify the compliance of these services with local regulations before using them.