Bitcoin Holds Strong at $110K Today (May 23, 2025) — Is a $200K Surge Just Around the Corner?

Jakarta, Pintu News – The Bitcoin market is attracting attention again after breaking through the previous record high price of $111,000, marking an important moment for crypto investors and analysts.

In the midst of growing optimism, various bold projections have begun to emerge, one of which is from Standard Chartered, which predicts Bitcoin could reach $200,000 or the equivalent of Rp3,259,770,000 ($1 = Rp16,298) by 2025 and even $500,000 (Rp8,149,425,000) by 2028.

However, despite the price surge, experts like Nic Puckrin of The Coin Bureau think that the real euphoria has yet to begin.

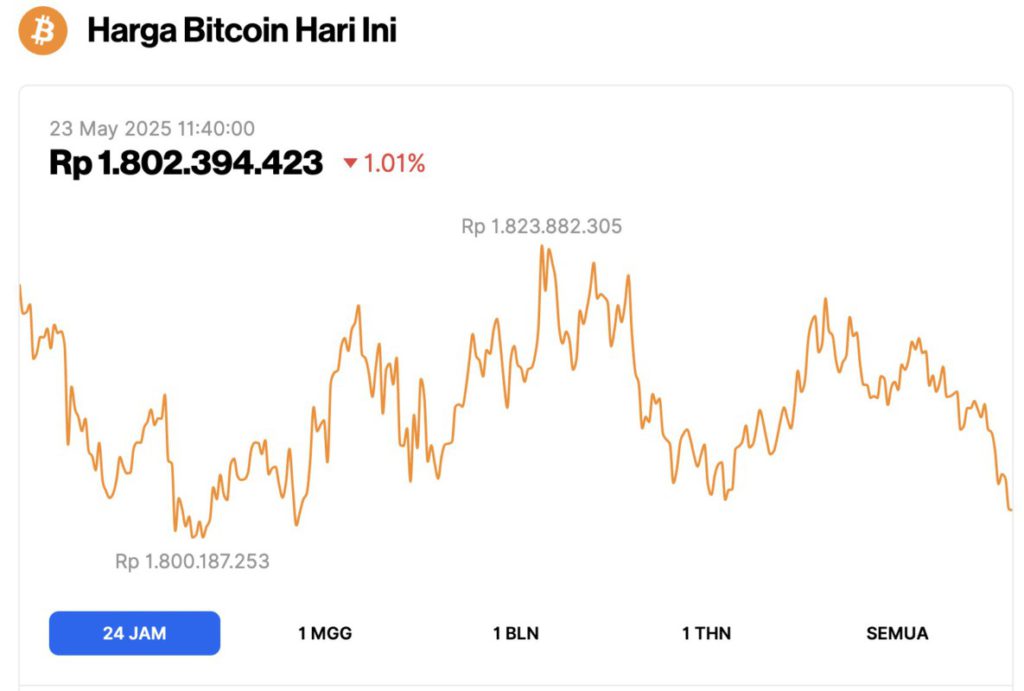

Bitcoin Price Drops 1.01% in 24 Hours

Read also: Bitcoin Soars to a New All-Time High of $111,880 on Pizza Day — What Happens Next Will Shock You!

On May 23, 2025, the price of Bitcoin was recorded at $110,616 or equivalent to Rp1,802,394,423, experiencing a 1.01% correction in the last 24 hours. During this period, BTC touched its lowest level at Rp1,800,187,253, and its highest price at Rp1,823,882,305.

According to CoinMarketCap, Bitcoin’s market capitalization now stands at around $2.19 trillion, with trading volume in the last 24 hours falling 30% to $62.11 billion.

Standard Chartered Predicts Bitcoin Price to Reach $200,000

Standard Chartered Bank reiterated its optimistic view on Bitcoin by projecting the cryptocurrency’s price to reach $200,000 by the end of 2025, and potentially jump to $500,000 by 2028.

This projection is supported by the growing interest in Bitcoin from institutions and governments, particularly through indirect investments in companies like MicroStrategy that have large Bitcoin reserves.

“My official forecasts for Bitcoin are $120,000 by the end of the second quarter, $200,000 by the end of 2025, and $500,000 by the end of 2028 – all very possible,” Kendrick said.

Geoff Kendrick, Standard Chartered’s Global Head of Digital Asset Research, highlighted that recent filings with the US Securities and Exchange Commission (SEC) show a significant increase in government entity ownership of Bitcoin proxy assets.

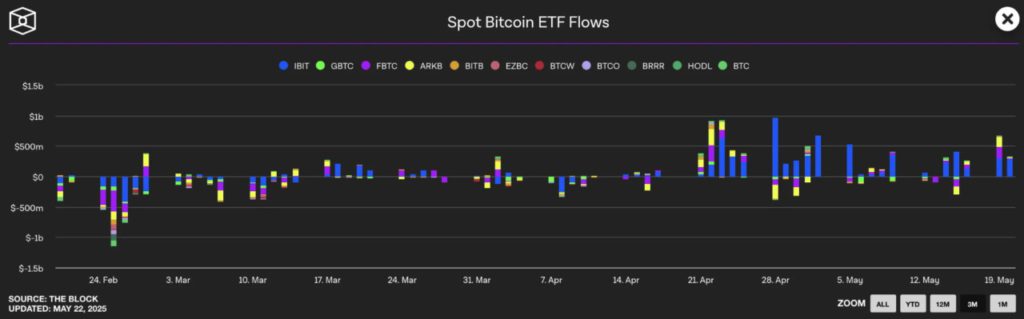

US Spot Bitcoin ETFs Record $7.2 Billion Inflows

In the first quarter, 12 government-related institutions, including a US state pension fund and a foreign central bank, increased their holdings in MicroStrategy, which equates to approximately 31,000 Bitcoin in the form of shares.

The bank also noted a notable change in investment patterns, with Bitcoin exchange-traded funds (ETFs) experiencing large inflows of funds.

Read also: BTC Strengthens, Bitcoin Price Forecasted to Reach $600,000 by October 2025

In the last five weeks, spot Bitcoin ETFs in the US recorded net inflows of $7.2 billion, while gold ETFs saw outflows of $3.6 billion during the same period. This trend indicates investors’ increasing preference for Bitcoin as a safe-haven asset over traditional options like gold.

“The rotation of safe haven assets in ETFs continues, and since April 22, the highest gold prices have caused gold ETFs to see $3.6 billion in withdrawals, while BTC ETFs have added $7.5 billion,” Kendrick added.

“The latest 13F data shows an expansion of government purchases of BTC proxies, and this is likely to continue in the second quarter.”

Government Institutions are Getting into Bitcoin

Furthermore, Kendrick notes that these investments are often triggered by regulatory constraints that prohibit direct ownership of Bitcoin, so relevant entities look for alternative ways to gain exposure to Bitcoin.

He observed that some government-related institutions are increasingly increasing their exposure to Bitcoin through indirect channels, such as investing in companies with large Bitcoin reserves. This trend is likely influenced by regulatory restrictions that limit direct ownership of Bitcoin by such entities.

In addition, Kendrick emphasized the correlation between Bitcoin’s performance and macroeconomic factors, especially the US Treasury term premium.

He explained that the high term premium, which is influenced by factors such as the weakening of Japanese government bonds (JGBs), is one of the reasons Bitcoin is increasingly attractive amid the risks facing the traditional financial sector.

In addition to the $200,000 price target for 2025, Standard Chartered also projects in the long term that Bitcoin could reach $500,000 by 2028. This view is supported by forecasts of continued favorable regulatory developments as well as increased adoption by institutions.

Bitcoin Surges – But the True Euphoria Hasn’t Started Yet

Nic Puckrin, crypto analyst, investor, and founder of The Coin Bureau, told the BeInCrypto website:

“After months of struggle, Bitcoin has finally broken through its previous record high, and what makes it even more special is that last night’s closing price was above that level.”

Read also: Leave Gold, Now Bitcoin (BTC) is the Asset of Choice in America!

According to Puckrin, this breakout marks a significant change in market sentiment and strength.

“And this time, it’s completely different – this rally looks much more sustainable compared to the one we saw in January, which was largely driven by unrealistic expectations about the impact of the Trump presidency on digital asset markets.”

With Bitcoin now entering unexplored price territory, he believes further gains could happen quickly.

“We are currently in a price discovery phase, and we could see a relatively quick upward move towards $120,000, although there may be some resistance around $115,000 as traders take profits. But in the long term, I don’t believe anyone thinks Bitcoin has peaked in this cycle, with $150,000 still being my baseline prediction.”

Puckrin bases his view not only on price movements, but also on broad indicators that suggest there is no retail market fever-at least for now.

“There are several reasons that make me think so. ETF fund flows, implied volatility of Bitcoin options, as well as Google search trends are still relatively calm compared to when BTC first broke the $100,000 mark, which shows that the euphoria hasn’t happened yet. There will be turmoil when we cross the $120,000 mark, but there is still room for BTC to go higher.”

He also highlighted macroeconomic conditions, with global liquidity as one of the main driving factors.

That’s the latest information about crypto. Follow us on Google News to stay up-to-date on the world of crypto and blockchain technology.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference: