Top 5 Bitcoin, Crypto News Updates Today (08.05.2025)

Here are the top five Bitcoin and crypto market news updates as of today (May 8, 2025).

1. UK and US Announce Trade Deal

The United States and the United Kingdom have finalized a trade deal reducing tariffs on key goods. The U.S. will cut tariffs on British cars from 27.5% to 10% and scrap steel and aluminum duties. In return, the UK will lower tariffs on U.S. products, including beef and ethanol, and agree to purchase $10 billion in Boeing aircraft.

The UK’s digital services tax remains unchanged, though both sides pledged to work on a future digital trade agreement. President Trump and Prime Minister Starmer hailed the deal as a “breakthrough” that strengthens economic ties amid ongoing global trade tensions.

2. Fed Warns of Economic Risks from Tariffs, Keeps Rates Unchanged

The Federal Reserve has kept interest rates unchanged at 4.25%–4.5% as it evaluates the economic fallout from President Trump’s trade policies.

Fed Chair Jerome Powell warned that prolonged tariffs risk higher inflation, slower growth, and rising unemployment. He noted growing economic uncertainty but said current policy remains appropriate while the Fed monitors the situation.

Trump has pushed for rate cuts to counter potential downturns, adding tension between the White House and the Fed. Powell declined to address Trump’s calls directly but highlighted concerns about stagflation, where inflation stays high even as growth slows.

Tariffs have already disrupted business plans, raised costs, and stalled some imports, raising the risk of shortages and price hikes.

3. Bitcoin Crosses $100,000 Milestone as Bullish Santiment Grows

Bitcoin crossed the $100,000 mark as bullish momentum built, reflecting investor optimism fueled by improving trade deals.

Estimates place Bitcoin between $120,000 and $250,000 by late 2025, and BlackRock’s Larry Fink sees the potential for $700K with modest institutional adoption.

Elsewhere, Shiba Inu is nearing a breakout, while Solana struggles to break past $151. Bitcoin’s next move—especially if it breaks $100K—could define the crypto landscape for the rest of the year.

4. Ethereum Pectra Upgrade: Boosting Staking and Flexibility

On May 7, Ethereum successfully launched its Pectra upgrade, bringing significant improvements for validators and the overall network.

The upgrade increases the staking limit from 32 ETH to 2,048 ETH, allowing users to stake larger amounts in a single transaction and reducing the need for multiple validator nodes. This change streamlines operations, improves efficiency, and also introduces automatic reward compounding for smaller stakers, allowing both new and existing validators to earn rewards on their full stake.

The upgrade includes 11 Ethereum Improvement Proposals (EIPs) designed to improve the network’s performance, scalability, and user experience.

5. USD1 Stablecoin Crosses $2 Billion Market Cap

USD1, the stablecoin issued by World Liberty Financial (WLFI) and affiliated with former President Donald Trump, surged from under $130 million on April 27 to over $2.1 billion by early May.

Blockchain explorers and analytics platforms—including BscScan, CoinGecko, CoinMarketCap, and DefiLlama—recorded multiple large mint transactions on BNB Smart Chain, ranging from $50 million to $99 million, driving a supply increase of more than $720 million within 24 hours.

The supply spike coincided with Abu Dhabi investment firm MGX’s announcement on May 1 that it would use USD1 to settle a $2 billion investment into Binance. MGX’s decision appears to have triggered the rapid minting, according to The Block’s research analyst Brandon Kae.

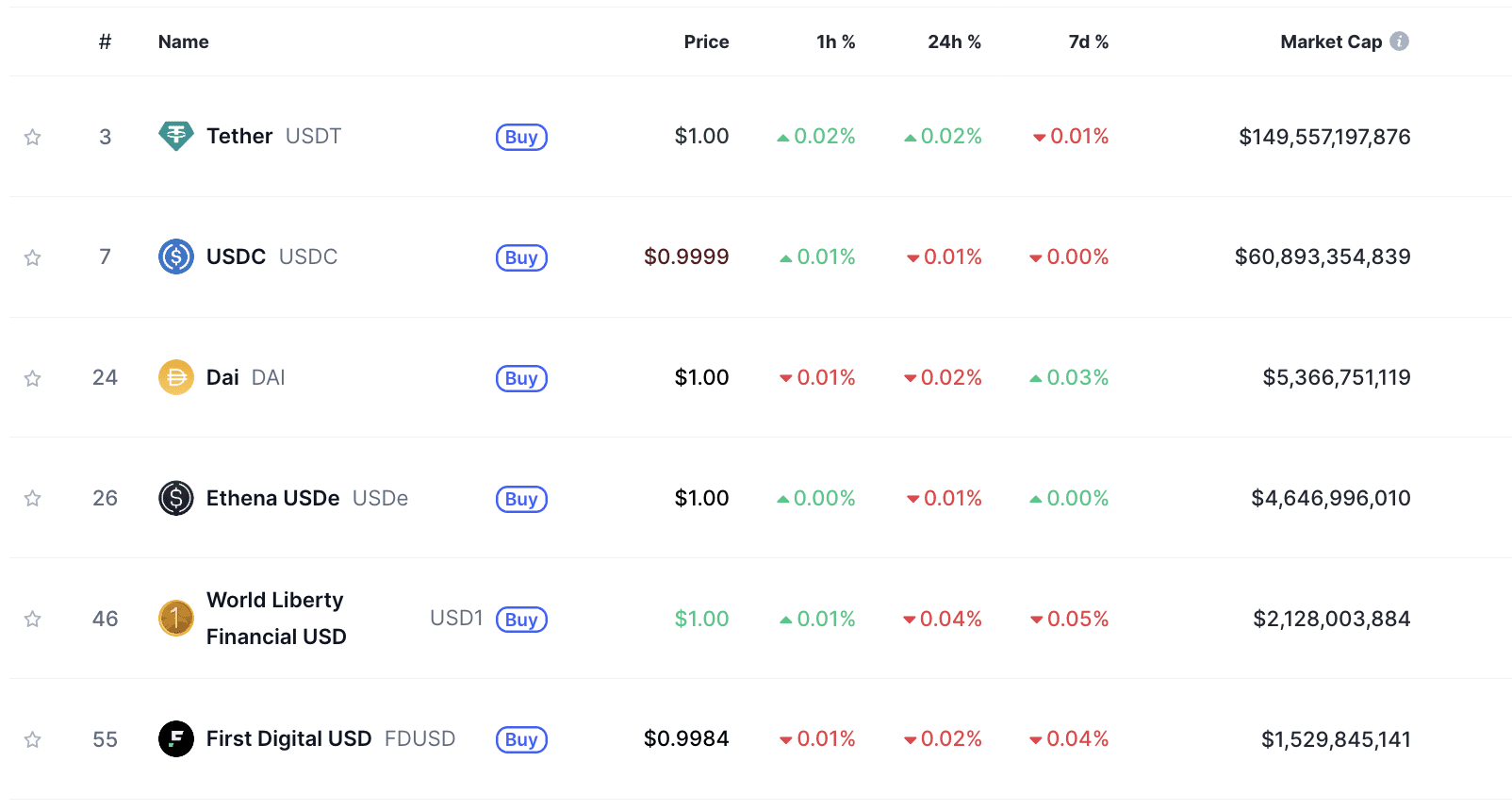

Launched officially in April and backed by short‑term US Treasury bills, dollar deposits, and cash equivalents, USD1 also plans an airdrop to WLFI tokenholders to test its on‑chain distribution model. Its entry into the $231 billion stablecoin market—dominated by Tether’s $149 billion USDT and Circle’s $60 billion USDC—marks USD1 as a rising contender.