3 RWA Altcoins Catch Investors’ Attention in May 2025!

Jakarta, Pintu News – Tokenization of real-world assets (RWAs) is increasingly becoming a major focus in the crypto ecosystem, especially after the Mantra platform collapse incident that exposed operational flaws in the decentralized RWA model.

These events prompted institutional and retail investors to seek more regulated and trusted tokenization platforms. In this context, three RWA altcoins-Ondo (ONDO), Reserve Rights (RSR), and TokenFi (TOKEN)-showed prominent performance and attracted market attention in May 2025.

Stability and Stablecoin Adoption in the RWA Ecosystem

After the Mantra incident, there was a significant shift towards more regulated RWA platforms. Stablecoins and tokenized government bonds provide a bridge between traditional finance and blockchain infrastructure, offering greater stability than speculative crypto assets.

According to Edwin Mata, CEO of Brickken, RWA tokens backed by real assets and governed by a legal framework tend to be more resilient to general crypto market volatility. This makes stablecoins and bond tokenization a top choice for investors seeking stability in their portfolios.

Also Read: Ripple (XRP) Moves $1.1 Billion, What Happened?

Ondo (ONDO): Leader in Bond Tokenization

Ondo Finance has expanded its reach by allowing USDY tokens backed by US government bonds to be accessed on the Solana network. This move increases interoperability and efficiency in the transfer of real assets on the blockchain. The price of the ONDO token has increased, reflecting high investor interest in the project. With a strong market capitalization, Ondo shows significant growth potential in the RWA ecosystem.

Reserve Rights (RSR): Providing Stability through Stablecoins

Reserve Rights focuses on developing stablecoins backed by a portfolio of assets, including bonds and fiat currencies. The model aims to provide a stable and regulated alternative in the DeFi ecosystem. With the growing demand for transparent and secure stablecoins, RSR is strategically positioned to meet the needs of a growing market. RSR’s price performance is showing a positive trend, supported by increasing adoption and investor confidence.

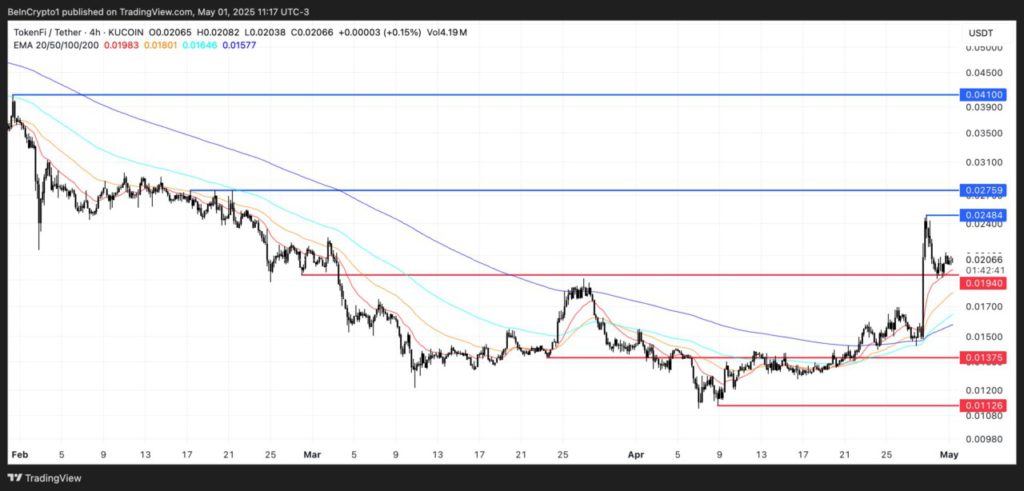

TokenFi (TOKEN): Simplifying Tokenization of Real Assets

TokenFi offers a platform that enables the tokenization of various real assets, including real estate and commodities. By providing a user-friendly infrastructure, TokenFi makes it easy for individuals and institutions to convert physical assets into tradable digital tokens.

This approach opens up new opportunities for investment and asset liquidity, attracting investors seeking portfolio diversification. TOKEN’s performance has shown steady growth, reflecting market confidence in its business model.

Conclusion

Developments within the RWA sector show a shift towards more regulated and stable platforms, with stablecoins and government bond tokenization being the main drivers of adoption.

Three altcoins-Ondo, Reserve Rights, and TokenFi-showed prominent performance in May 2025, reflecting investor interest in secure and efficient real asset tokenization solutions. With the increasing integration between traditional finance and blockchain technology, the RWA sector is expected to continue to expand and play an important role in the global financial ecosystem.

Also Read: Worldcoin: Innovating Digital Identity Verification Through Iris Scanning

That’s the latest information about crypto. Follow us on Google News for the latest crypto and blockchain technology updates. Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference: